The

European Public Limited Company

SE (Societas Europaea)

With taking effect of the corresponding law at

29.12.2004 the European public company (Societas Europaea, or short: SE)

is been established.

Aim of this new supranational public limited

company,it is to be relieved international business-unions,

concern-educational processes and business-co-operations within the

European Union. Through the creation one of singles-state society-laws

and largely independend social system as business-bearers should be

reduced the existing society-legal, fiscal and psychological

impediments.

Formation

Basis of

the regulations to introduction of the SE is two legal acts of the

European union:

- “The ordinance over the

SE...” and the

complementary

- “Guidline over the

participation of the employees in the SE...”

The

foundation of an European public company can take place in form of

society-legally:

A SE can

according to type 2 VO through amalgamation is established

- either through inclusion

- or through formation of a new

company.

A

SE can originate according to type 32 VO in form

of a Holding-SE.

The

foundation can from at least two companies (Plc or Ltd.) with their

seat in a member state, is enforced.

Societies

and legal persons (public and private right), that have been founded

after right of a member state, with seat and headquarters in the EC,

can establish a subsidiary-SE according type 35 VO.

A Plc,

that has been founded by the right of a member state and has its seat

and headquarters in the EC, can be tranformated into a SE according

type 37 VO, if it has had a subsidiary subject to the right of another

member state for at least two years happens.

All the foundation-forms common is an international

element.

At least two of the originator-societies must be

subject to the right of different member states.

Still it is to be heeded with the

foundation-possibilities, that there is not a bar- or fact-foundation

through natural persons.

The minimum capital amounts to 120.000 Euro.

The SE is

written down into the register of the member state, in which it has

its statuory certain seat. This seat must correspond to the seat of

the headquarters. Supplementary the registration is published in the

official gazette of the EC.

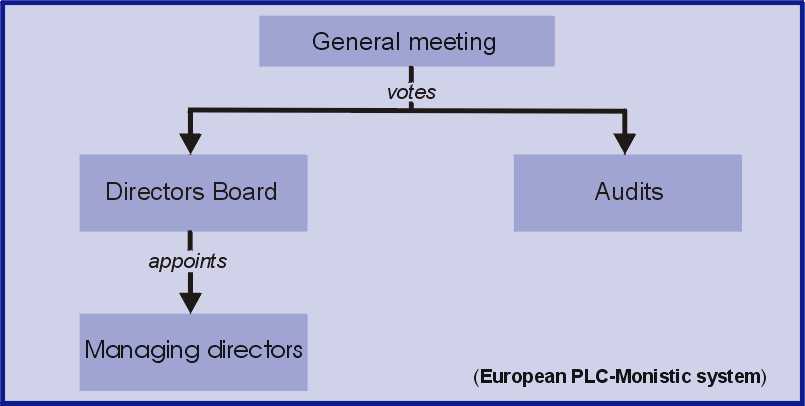

Organization

The

inner organization-form can be chosen optional: the dual system with

separation of executive and supervisory board (Germany) or the

monistic model (England, France).

Characteristic

for the monistic system is that a administrative council, a “board

of directors”, that SE leads and decides the baselines of the

activities and oversees their transposition. The board consists only

of not business-leading members . At least 3 members must be chosen

for 5 years. At least 6 meetings must

be determined per year. The administrative council orders

one or several managing directors for the current management.

These are not members of the directors board, at the decisions of the

administrative council bound and can be recalled anytime.

Tax

The taxation of the current business activity, the

profit-investigation an the preparation of the tax-explanation of

the SE takes place after the national tax-right of the respective

seat-state. The SE draws up a annual account. It consists of

balance-sheet, profit- and loss calculation, the appendix, just as

the progress report. The founders have the possibility to determine

the board as well as the executive and the board for the observation

of the annual account.

A study of the European commission of 05.10.2001

over the possibility of an EC-far of uniform fiscal allocation-basis

could not yet be moved until now.

Participation

The entrepreneurial co-determination was the

biggest obstacle that was valid to overcome it to the creation of an

European public company.

First, employers and employees can agree on an any

co-determination-model. Remains the model behind the

co-determination-level one of the

foundation-businesses, it, according to degree of

the deviation, needs a

certain qualified consent-majority of the

employees.

With these negotiations over an agreement between

employers and employees, primarily following points are to be

regulated:

- the composition of the agency-organ of the employees

and his authorities

- the procedure over the instruction and hearing

- the co-determination of the employees in the board

or administration-organ.

The negotiation-duration is restricted on 6 months,

can be extended by agreement of the negotiation-partners on 1 years

however.

Also union-representatives, that are not busy in

the business, can belong the negotiation-committee.

Achieve the special negotiation-committee (BVG)

within the negotiation-time period with the organs of the involved

societies no unification, the so-called “Auffangregelung” finds

application for the employee-participation.

Be subject to rules over the

business-co-determination one of the involved societies after national

right, must admit also the SE employee-representatives to its

supervisory - or administration-organ after the “Auffangregelung”

so, in fact in accordance with the numerical relationship, that was

decisive for it, the nation-state-like co-determination-right subject

to society.

In the case of the conversion of a society into a

SE, all co-determination-rules current before the conversion find

application also after the conversion unchanged. No one of the

participant was subject to after national right, regulations over the

co-determination, so, also the SE is not committed to admit

employee-representatives to its supervisory - or administration -

organs.

Outlooks

It will turn out which word this new social system

will find in the near future. Interestingly, this could be for

businesses, wants to bring in the miscellaneous subsidiary into a SE,

about this way the administration-expenditure one everyone daughter

considerably reduces and, to manage expenses-decrease consequently.

For legal and tax-law reasons, also a

seat-publishing can be into another EC-member state of advantage.

On the other hand, another prosecution of the

construction of an EC-uniform fiscal allocation-basis could on basis

of IAS/IFRS of the 4. EC-balance-guideline to an aligned taxation of

the member states leads.

Whether with the European public company (SE) the

long called in, from nation-state-like regulations relieved social

system to the disposal is joined, seems quite doubtful in view of the

numerous areas, in which the society is subject to the respective

national rules over public companies. One thinks of problem with

co-determination-right only of it and at the country-specific tax

collection.

© ESI 2005

|